“FROM GREECE TO CALIFORNIA TO JAPAN, markets are beginning to worry about what traditionally is deemed a risk-free asset: government debt securities. And that arguably lies behind the rise in the price of gold. The traditional worry about excessive government debt is that it can be inflated away by central-bank money printing. The Federal Reserve can always buy Treasury securities without limit, forestalling any chance of default by the U.S. government. That, however, would involve an expansion of the central bank’s balance sheet and, inevitably, produce Weimar-style hyperinflation.”

Government Bonds — the New Junk?

January 19, 2010Investors Bet on Resurgence of Inflation

December 13, 2009Even as signs of deflation linger, some investors are moving to protect themselves against any surge in inflation.

They fear the Federal Reserve will move too slowly reverse the unprecedented flood of cash it pumped into the financial markets in response to the global financial crisis. With the crisis now seen as over, they feel the Fed could be setting the stage for a meaningful rise in inflation over the next several years by pledging to keep interest rates essentially at zero for the foreseeable future.

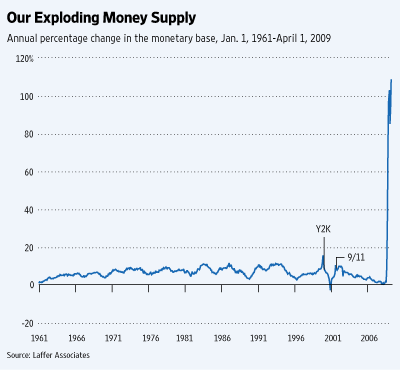

Money Supply

June 20, 2009

Unprecedented 7-8X money supply. This means one thing: inflation. The question becomes, WHEN?

Preparing Your Portfolio for Inflation

June 13, 2009From the New York Times

“Most economists don’t expect inflation to arrive anytime soon. But nobody really knows when it will appear or how corrosive its effects will be. In the meantime, financial planners are suggesting that investors make sure that their portfolios are well positioned to withstand any impact on their hard-earned money — before it’s too late.”

“… inflation can quietly sneak up on you, and at that point it will be more expensive — or less effective — to get the inflation protection you need. It’s especially rough on people who live on fixed incomes, notably retirees, many of whom have already suffered painful losses in their portfolios.

“The problem is if you wait until we are actually in it,” said Chuck Roberson, a financial planner with Modera Wealth Management in Old Tappan, N.J., “it will be too late or the strategies won’t work as well.”

The article recommends TIPS (US gov’t inflation indexed bonds), Commodities and Real Estate as strong performing assets for an inflation protection.

The Crisis of Credit Visualized

May 19, 2009Here is a must-see primer on the machinations of the credit crisis that got us into this mess (and how bailouts are the antithesis approach to containing inflation):

The Crisis of Credit Visualized from Jonathan Jarvis on Vimeo.

And don’t forget to enjoy your monetary devaluation!

Hedge Funds Making Big Bets on Gold

May 19, 2009Dow Jones reports from New York:

“Hedge fund firms Paulson & Co. and Lone Pine Capital made big bets on gold during the first quarter, becoming the No. 1 and No. 2 shareholders, respectively, in the SPDR Gold Trust (GLD) exchange-traded fund, according to regulatory filings. Paulson, a merger arbitrager by trade, became the highest-paid hedge fund manager in 2007 when he bet against securities tied to subprime mortgages. His funds also produced double-digit gains in 2008, when the industry as a whole showed an average loss of 19%.”

“Many hedge fund managers have been increasing their gold investments lately. More than 28% of the SPDR Gold Trust ETF’s outstanding stock was owned by hedge funds as of the end of the first quarter, according to Factset Research Systems. The increased bets on gold come as the price of the yellow metal have remained high, above $900 an ounce. Funds also see hard assets as insurance against further turmoil in the financial system, including a decline in the value of paper currency.”

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/images/quotes_special.gif)